I’m entering my third decade of riding motorcycles. Through the years, I’ve found a few bikes to love, some fun ones, and the occasional model I’ll never use again.

Whether I’m on a scooter, a moped, or something else, I’ve found that the one common denominator is to have motorcycle insurance.

Didn't You Try Our Quote Comparison Tool Yet? Save BIG by Doing it!

Even when you’re on an under-50cc model, there is always a risk of something happening. In my case, I was rear-ended while driving through a small town in Wisconsin. It was a hit-and-run, and I got ejected from the bike and slammed into a parked car.

Thankfully, someone saw the collision. I only remember a little, but they found my information and stayed there until more help arrived.

Scooter and moped insurance are available in all 50 states and the District of Columbia. Even when it isn’t required, I highly recommend looking at quotes for your make and model. You never know what might happen.

I’ve tried to get at least three competitive quotes for my motorcycle insurance, but asking each company for this information is worthwhile. Since rates are highly variable based on your driving record and where you live, I’ve found that restarting this process every two or three years can be an excellent way to save money.

Table of Content

How Much is Scooter and Moped Insurance Annually?

Since scooter and moped insurance is highly individualized, the quotes I can get differ from those for everyone else.

I’ve compiled the rate-based information released by all the national and regional motorcycle insurance providers. These quotes are then averaged, with the top two providers explicitly listed for your consideration.

In our analysis, the average yearly scooter or moped insurance in the US is:

- Liability-only: $148.88

- Full coverage: $382.34

Full coverage includes comprehensive, and collision coverage and is about 2.6 times more expensive than a minimum liability policy.

Factors that impact scooter insurance rates in the US:

- Age of the operator

- Driving history of the operator

- Type of scooter being insured

- Location where the scooter is driven

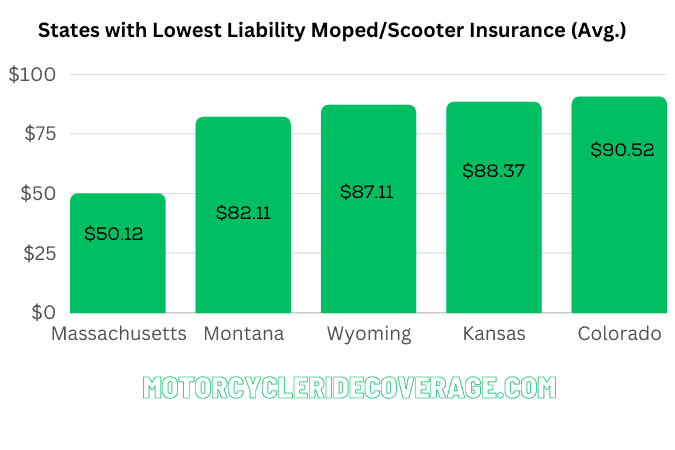

Below is the breakdown of state-by-state lowest cost so you get a clearer picture of what’s happening in your location.

I’ve included a liability-only section and one with full coverage, including comprehensive and collision.

This data is based on the following motorcyclist profile.

- Clean Driving Record

- Age 35 with Four Years of Riding Experience.

- A 2022 Honda Super Cub 125 (125cc Engine).

- Credit Score of 720.

- Zero Claims or Citations in the Past 5 Years.

| States | Lowest Liability Only | Lowest Full Coverage | Cheapest Insurance Provider(s) |

| Alabama (AL) | $60 | $174 | Markel**, Progressive |

| Alaska (AK) | $50 | $158 | Randall Moss, Progressive |

| Arizona (AZ) | $76 | $246 | Progressive, Dairyland |

| Arkansas (AR) | $68 | $189 | Markel**, Dairyland |

| California (CA) | $79 | $210 | GEICO |

| Colorado (CO) | $58 | $230 | Markel**, Dairyland |

| Connecticut (CT) | $113 | $188 | Nationwide, Dairyland |

| Delaware (DE) | $75 | $240 | Markel**, Harley-Davidson |

| Florida (FL) | $58 | $200 | Markel, Progressive |

| Georgia (GA) | $57 | $277 | Markel, Allstate |

| Hawaii (HI) | $77 | $236 | Progressive, GEICO |

| Idaho (ID) | $62 | $233 | Markel, Dairyland |

| Illinois (IL) | $104 | $305 | Nationwide, Progressive |

| Indiana (IN) | $75 | $175 | Progressive, Dairyland |

| Iowa (IA) | $50 | $132 | Markel**, GEICO |

| Kansas (KS) | $75 | $115 | Progressive, Dairyland |

| Kentucky (KY) | $106 | $255 | GEICO, Dairyland |

| Louisiana (LA)* | $69 | $536 | Farm Bureau, GEICO |

| Maine (ME) | $101 | $185 | Progressive |

| Maryland (MD) | $120 | $175 | USAA, Progressive |

| Massachusetts (MA) | $33 | $76 | Allstate, Progressive |

| Michigan (MI) | $167 | $379 | Markel, Progressive |

| Minnesota (MN) | $50 | $146 | Markel**, Progressive |

| Mississippi (MS) | $75 | $275 | Progressive, Dairyland |

| Missouri (MO) | $127 | $307 | GEICO, Progressive |

| Montana (MT) | $50 | $115 | Markel**, GEICO |

| Nebraska (NE) | $99 | $287 | GEICO |

| Nevada (NV) | $59 | $263 | Markel, Progressive |

| New Hampshire (NH) | $99 | $167 | GEICO |

| New Jersey (NJ)* | $150 | $457 | GEICO, Progressive |

| New Mexico (NM) | $75 | $210 | Freeway Insurance, Progressive |

| New York (NY) | $75 | $183 | Markel**, Progressive |

| North Carolina (NC) | $82 | $179 | Nationwide, Harley-Davidson |

| North Dakota (ND) | $75 | $134 | Progressive, Harley-Davidson |

| Ohio (OH) | $75 | $141 | Markel**, GEICO |

| Oklahoma (OK) | $75 | $249 | Progressive |

| Oregon (OR) | $111 | $233 | Nationwide, Dairyland |

| Pennsylvania (PA) | $59 | $181 | Markel**, Progressive |

| Rhode Island (RI) | $192 | $211 | Dairyland |

| South Carolina (SC) | $110 | $249 | Progressive |

| South Dakota (SD) | $91 | $152 | Progressive, Dairyland |

| Tennessee (TN) | $50 | $225 | Markel**, Dairyland |

| Texas (TX) | $77 | $205 | USAA, Dairyland |

| Utah (UT) | $50 | $209 | Markel**, Dairyland |

| Vermont (VT) | $125 | $219 | Markel, Harley-Davidson |

| Virginia (VA)* | $120 | $525 | GEICO, Progressive |

| Washington (WA) | $52 | $179 | Markel** |

| West Virginia (WV) | $146 | $264 | Dairyland |

| Wisconsin (WI) | $75 | $168 | Progressive |

| Wyoming (WY) | $63 | $137 | Markel**, Progressive |

| District of Columbia (DC)* | $322 | $613 | State Farm, USAA |

| YEARLY AVERAGE | $89 | $231 |

(*) Rates in these states are highly variable based on exact geographic location, driver history, and insurer policies. Please request a quote to receive your specific rate.

(**) “Markel Specialty” in the areas where traditional motorcycle insurance isn’t offered, but you can still get a policy for a moped or scooter.

Why Are Liability and Full Coverage Rates Similar in Some States?

Mopeds and scooters are often treated as motorcycles for insurance purposes, but that is not the case in all states.

When I researched rate-based information in Connecticut, Kansas, Maine, Maryland, Massachusetts, and Vermont, the rates were similar for liability and full coverage (comprehensive and collision) because of local laws or user requirements for low-displacement engines.

Local statutes are also variable in many of these states, so someone with a rural address could see a significantly different quote than someone living in a large city.

Some insurers classify mopeds and scooters as vehicles different from motorcycles, while others lump them into a single two-wheeled category. If you think a quote is unreasonably high, ask if they have a specific policy for your 125cc engine or below.

Average Cost of Scooter/Moped Insurance State by State

Insurance Rates in Connecticut

Connecticut requires scooter and moped insurance to meet the state’s liability coverage limit minimum. That means the average cost of a liability-only policy is $150.83.

Nationwide ($113) and Progressive ($115) are the most affordable providers for the average rider.

For those seeking full coverage, the average policy quote is $349.16. Dairyland ($188) and Harley-Davidson Insurance ($232) provide the cheapest rates.

Insurance Rates in Maine

Maine requires scooter and moped insurance to meet the liability coverage limits when operating on public roads. The average cost of a liability-only policy meeting this definition is $127.67.

Progressive ($101) and Nationwide ($129) are the most affordable providers for the average rider.

Scooter and moped riders wanting full coverage can expect an average policy quote of $318.83. Progressive ($185) and Harley-Davidson Insurance ($255) provide the cheapest rates.

Insurance Rates in Massachusetts

Insurance quotes in Massachusetts for scooters and mopeds allow for different user needs, reflecting the low-speed nature of their design. The average cost for liability-only is $50.12, while a full coverage policy with enhanced benefits is $115.64 monthly.

Progressive ($32.68) and Nationwide ($56.97) offer the best rates for basic coverage. Those wanting enhanced policies will want to look at Allstate ($76) and GEICO ($95.80).

Insurance Rates in New Hampshire

The average scooter insurance cost (including mopeds) fits into a generalized motorcycle category in NH. GEICO offers the cheapest liability-only policy ($99), while Progressive is a bit higher ($140). Both options are below the $205.50 average in the state.

GEICO offers a $167 annual rate for those wanting comprehensive and collision, while Progressive’s is $264 annually. The average annual rate in the state is $358.16.

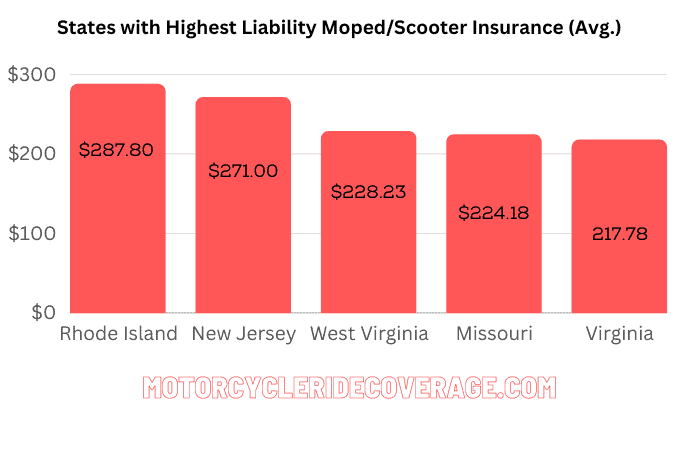

Insurance Rates in New Jersey

Riders seeking a liability-only policy for scooters and mopeds can look to GEICO ($150) and Progressive ($161) for competitive quotes. The state’s average is $271.

Progressive offers the best rate at $457 per year for full coverage benefits and enhanced coverage. Dairyland is also competitive, quoting $492 annually. The average policy cost in this category is $557.

Insurance Rates in New York

The average moped insurance cost (including scooters) in New York is $123.83 for a liability-only policy. Markel Specialty and Progressive both offer options at just $75 annually.

Progressive offers full coverage at $183 per year for riders wanting comprehensive and collision benefits. GEICO stays competitive at $223.

The average cost of full coverage in NY is $281.84.

Insurance Rates in Pennsylvania

Pennsylvania is one of the cheapest places for moped and scooter insurance in the Northeast. Markel Specialty offers a policy at $59 per year, while Progressive delivers at $75 annually. The average annual premium in the state is $99.87.

Progressive ($181) and Dairyland ($233) provide the best rates when full coverage is desired. The average annual policy cost in this category is $283.66.

Insurance Rates in Rhode Island

Dairyland ($192) and Harley-Davidson ($244) offer the cheapest moped and scooter insurance quotes in RI. The average policy cost is $287.80.

Dairyland ($211) and Harley-Davidson ($257) offered incredible deals for full coverage, beating the state average for liability-only while adding comprehensive and collision. The state average is $564.60 for having full coverage.

Insurance Rates in Vermont

The average 125cc scooter insurance cost in Vermont is $189.55. Markel ($125) and Harley-Davidson ($129) offer the most affordable quotes.

Harley-Davidson ($219) and Dairyland ($221) provide the cheapest options for full coverage. The annual average in this category is $355.40.

Insurance Rates in Alabama

Markel Specialty ($60) and GEICO ($70) offer the lowest liability insurance quotes, while Progressive ($174) and Harley-Davidson ($225) had the best with comprehensive and collision.

Scooter and moped riders can expect to pay an average of $229.87 annually.

Insurance Rates in Arkansas

Markel Specialty ($68) and GEICO ($75) offer the best quotes for liability insurance. With comprehensive and collision, Dairyland ($189) and Harley-Davidson ($222) came out on top.

Riders can expect to pay an average of $411.30 for full coverage or $122.50 for liability.

Insurance Rates in Delaware

Markel Specialty was the cheapest liability insurance quote for scooters and mopeds at $75 per year. Harley-Davidson was second at $157.

Harley-Davidson was the best ($240) for full coverage, and Markel was second at $296. Expect to pay about $189.95 for liability or $477.88 with comprehensive and collision.

Insurance Rates in Florida

Florida doesn’t require motorcycle insurance. Riders can file for a certificate of financial responsibility.

For those that seek quotes, Markel starts at $58 per year, while Progressive is at $70. Adding comprehensive and collision made Progressive ($200) and Markel ($288) the most affordable options.

Riders can expect to pay $361 annually for full coverage or $109.89 for liability only.

Insurance Rates in Georgia

Markel ($57) and Progressive ($75) had the best annual liability insurance quotes for scooters and mopeds. Riders can expect to pay $101.17, on average.

Adding comprehensive and collision made Allstate the cheapest provider at $277 annually. Dairyland was second at $301, while the state average was $552.27.

Insurance Rates in Kentucky

In KY, GEICO ($106) and Harley-Davidson ($108) had the best rates, although the average was close, at $144.55.

With full coverage, Dairyland ($255) is the best. Progressive offered a $380 quote, while the average amount to pay is $459.23 annually.

Insurance Rates in Louisiana

Farm Bureau offered the best liability-only rate at $69 per year. GEICO offered a $99 rate, while the average is $160.

With comprehensive and collision, all providers offered a quote above $500. GEICO was the best ($536), followed by Farm Bureau ($545), which is right on the state average.

Insurance Rates in Maryland

USAA offered the best rate for qualifying members at $120 per year. Progressive provided a quote of $128.

With full coverage, Dairyland was the best ($175), and Progressive was close at $198. Riders can expect a state average of $311.88.

Insurance Rates in Mississippi

Moped and scooter riders in this state can find liability-only insurance for $75 from Progressive or $99 from GEICO as the best rates. The average policy cost in this category is $111.00.

Dairyland ($275) and Progressive ($292) offered the best rates to meet full coverage needs. The average policy with comprehensive and collision is $530.17.

Insurance Rates in North Carolina

Nationwide ($82) offered the best liability rate for scooters and mopeds, followed by GEICO ($99). With full coverage, Harley-Davidson ($179) and Progressive ($208) had the best rates.

Riders can expect to pay an average of $162.77 and $410.22, respectively.

Insurance Rates in South Carolina

Progressive ($110) and GEICO ($129) offered the best rates for liability insurance, with all providers averaging $216.84.

Adding comprehensive and collision caused rates to double, but Progressive ($249) and GEICO ($310) are the best. Regionality plays a significant role in your quote in this state.

Insurance Rates in Tennessee

The best rates came from Markel Specialty ($50) and GEICO ($70) for annual liability insurance. With full coverage, Dairyland ($225) and Progressive ($275) had the lowest quotes.

Riders can expect to pay an average of $100 for liability and $388.12 when adding comprehensive and collision.

Insurance Rates in Virginia

Progressive and GEICO quoted $120 annually for liability insurance on mopeds and scooters.

Adding comprehensive and collision makes Progressive ($525) the most affordable, followed by Nationwide ($530). The average cost is $688.25 in this category.

Insurance Rates in Washington, DC

State Farm offered the best insurance rate for DC riders, with a liability-only policy at $322 per year. GEICO was second at $355.

Adding comprehensive and collision made USAA the best provider at $613. State Farm provides a quote of $758.

In my research, Washington, DC, had the highest average insurance rates for riders.

Insurance Rates in West Virginia

The average rider can expect to pay at least $228.34 for moped and motorcycle insurance in WV, though Dairyland ($146) and Harley-Davidson ($205) had competitive pricing.

Adding comprehensive and collision doubles the average to $459.24. Dairyland ($264) and Harley-Davidson ($300) are the most competitive.

Insurance Rates in Illinois

Nationwide ($104) and Markel ($140) offered the cheapest scooter and moped insurance liability quotes. The state’s average for this coverage is $175.84.

Full coverage in Illinois is triple the cost. Progressive ($305) at the best rate, followed by Harley-Davidson Insurance ($332). The average is $475.10.

Insurance Rates in Indiana

The cheapest annual rates are at Progressive ($75) and GEICO ($100). Most providers quoted around $120 per year when I asked.

Adding yearly comprehensive and collision put Dairyland ($175) at the best rate, then GEICO ($225). Riders pay $488.45 on average.

Insurance Rates in Iowa

The base quotes of $50 at Markel Specialty and $75 at Progressive per year are the best scooter and moped rates.

When going with full coverage, GEICO ($132) and Progressive ($147) are much lower than everyone else. Expect to pay an average of $255.78 in the state.

Insurance Rates in Kansas

Progressive ($75) and GEICO ($99) are the best quotes I received for annual moped and scooter insurance. Every agency was competitive, with the highest rate for liability at $109 from Harley-Davidson Insurance.

With full coverage, Dairyland gave me a rate of $115. Harley-Davidson told me it’d be $152. The average amount riders pay in the state is $199.50.

Insurance Rates in Michigan

Markel and GEICO quoted me the same rate for scooter and moped insurance at $167 per year for a liability-only policy. That’s slightly lower than the $188.78 median.

Adding comprehensive and collision made Progressive ($379) and GEICO ($389) the best options.

Riders who need total coverage can expect an average of $484.87 per year for their insurance needs.

Insurance Rates in Minnesota

The best annual quotes came from Markel Specialty ($50) and GEICO ($70), although the median price for liability coverage was under $100.

Progressive ($146) was the cheapest when adding comprehensive and collision coverage. GEICO was close at $174, but both are much lower than the $266.45 average.

Insurance Rates in Missouri

For liability coverage, GEICO quoted $127 per year, while Progressive was at $150. The average policy cost in this area was $224.18.

With full coverage, Progressive was the best at $307, while GEICO went to $394. Both are still cheaper than the state average of $523.50.

Insurance Rates in Nebraska

GEICO ($99), Markel ($140), and Nationwide ($140) are the cheapest liability insurance quotes in NE, while the average was $201.15.

Adding comprehensive and collision made GEICO ($287) the best, while Dairyland ($297) was a close second.

The state’s annual average is $350.50 for riders.

Insurance Rates in North Dakota

The best quotes for annual liability insurance on scooters and mopeds came from Progressive ($75) and Markel ($87).

Riders will pay an average of $222 when adding comprehensive and collision coverage. Harley-Davidson ($134) and Dairyland ($141) had the best quotes.

Insurance Rates in Ohio

Markel Specialty and Progressive both offered $75 quotes for liability insurance. Regarding full coverage, GEICO ($141) and Dairyland ($175) offer the best rates.

Riders can expect to pay an average of $115.16 for liability and $314.84 for full coverage each year.

Insurance Rates in South Dakota

Progressive ($91) and GEICO ($99) are the only companies to offer a liability insurance quote for scooters and mopeds under $100. The average was $122.36.

With full coverage, Dairyland ($152) and Harley-Davidson ($165) offer the lowest rates against the $277.88 state average.

Insurance Rates in Wisconsin

Progressive ($75) and GEICO ($99) offered their base motorcycle insurance rates for mopeds and scooters for liability coverage. With comprehensive and collision, Progressive ($168) was the cheapest, with GEICO ($189) close behind.

Most riders can expect to pay $221.75 per year for their coverage requirements.

Insurance Rates in Arizona

Arizona’s average scooter insurance cost, including mopeds, is $115.48. Progressive ($76) and Markel Specialty ($81) provide the cheapest quotes.

Dairyland ($246) and Progressive ($262) offer the best rates for full coverage. The state’s average in this category is $385.50.

Insurance Rates in New Mexico

In NM, Freeway Insurance offers the best liability-only rates for mopeds and scooters, with an average cost of $74. Progressive policies average $75, while the state median is $188.50.

Progressive ($210) and Dairyland ($245) offer the best total coverage rates, while the state median is $348.33.

Insurance Rates in Oklahoma

Progressive ($75) and Markel Specialty ($78) offer the best rates for a liability-only policy in Oklahoma. The average cost for this option in the state is $128.89.

Progressive ($249) and Markel ($271) are still the best options when full coverage is necessary. The median quote for scooters and mopeds in this category is $301.94.

Insurance Rates in Texas

If you need moped or scooter insurance in Texas, USAA offers the best average rate at $77 per year. Progressive is a close second at $79, while the state median for liability-only coverage is $202.37.

Full coverage or enhanced benefits are more expensive. Dairyland averages $205, while Harley-Davidson Insurance quotes $292 annually.

The average policy quote for full coverage on mopeds and scooters is $412.33.

Insurance Rates in Alaska

Markel offers a competitive quote for liability-only coverage in Alaska at $50 per year. Randall Moss Insurance offered an average rate of $99 when contacted, while the state’s median is $101.68.

Full coverage raises the price to $158 (Progressive) and $165 (GEICO) per year. The state’s average is also higher, at $204.89 annually.

Insurance Rates in California

When running a liability-only policy that meets the state’s minimums, GEICO ($79) and Dairyland ($102) offer the best annual rates. The average is $211.44 in this category.

Riders wanting full coverage will want to look at GEICO ($210) and Progressive ($301). The average rate here is $425.50 with comprehensive and collision include.

Insurance Rates in Colorado

Markel Specialty ($58) and Progressive ($76) provide the state’s cheapest scooter and moped insurance rates. The average price for liability coverage is $90.50.

Dairyland ($230) and Harley-Davidson Insurance ($238) provide the lowest rates when considering full coverage.

The average cost for full moped or scooter insurance in Colorado is $293.43 annually.

Insurance Rates in Hawaii

Hawaii insurance rates for scooters and mopeds are highly variable, so it helps to shop around for quotes. In my research, Progressive ($77) had the best rate, while GEICO ($105) was still competitive for liability.

With full coverage, I discovered the places switched. GEICO was the best at $236, while Progressive charged $269. Markel was the only other company that got back to me, and they quoted $550.

Insurance Rates in Montana

Montana has some of the cheapest scooter and moped insurance rates in the United States. Markel Specialty ($50) and Progressive ($75) are competitive for liability only. The average rate is $82.11.

Full coverage is also very affordable. GEICO ($115) and Progressive ($119) offered the best rates, while the annual average is $176.88.

Insurance Rates in Nevada

Markel ($59) and Progressive ($75) offered the lowest rates for liability insurance. They are reversed when adding collision and comprehensive, with Progressive ($263) beating Markel ($285).

The averages are $133.83 for liability and $453.39 for full coverage.

Insurance Rates in Utah

Riders in Utah will find that Markel Specialty ($50) and Progressive ($75) offer the cheapest liability-only policies. Those quotes are significantly under the $119 state annual median.

With full coverage, Dairyland ($209) offers the best rate. Progressive ($232) is close behind, while the state’s average is $376.30.

Insurance Rates in Wyoming

For riders in Wyoming, Markel Specialty ($63) and Progressive ($75) offer the best entry-level liability-only rates. Every insurance company in the state quoted a price to me under $100.

With full coverage, the rates double. Progressive ($137) and Dairyland ($151) offered the best quotes. The state’s average for this coverage is $246.50.

Scooter and Moped Full Coverage Insurance Cost (US Map)

Insurance Rates in Idaho

The rates for scooters and mopeds in Idaho are based on the assumption that the equipment is street-legal. Markel ($62) and Progressive ($75) offer the cheapest annual rates for liability policies.

With full coverage, Dairyland ($233) and Harley-Davidson ($248) have the best options.

The averages are $147.60 (liability) and $488.37 (full).

Insurance Rates in Oregon

A full-coverage policy in Oregon is $367.89 per year, or about $30 per month. Dairyland ($233) and Progressive ($334) offer the best rates.

For liability-only coverage, Nationwide is just $111 annually, while GEICO charges $126 annually. The average cost for riders is $141.56.

Insurance Rates in Washington State

The companies offering the cheapest scooter and moped insurance rates in WA are Markel Specialty ($52) and Progressive ($75). No insurers offered a quote above $118.

Full coverage is provided by Markel ($179) and Dairyland ($190), while the annual premium average at this level is $288.10.

FAQ About Scooter and Moped Insurance Quotes

What Factors Affect Scooter and Moped Insurance Costs?

The primary factor for scooter and moped insurance is if the vehicle is covered by a general motorcycle policy. Ask each insurer if they will separate low-speed models to save money.

I don’t think a 125cc scooter insurance cost should equal a 1250cc motorcycle sports bike quote.

Where you live, how you use the moped or scooter, and your driving record also play roles in the eventual quote you’ll receive.

How Do Insurance Companies Calculate Premiums?

When calculating an individualized quote, insurers look at risk factors, coverage types, deductibles, product value, discounts, and external factors.

Age, gender, riding history, and geographic location significantly affect cost. Higher deductibles create lower premiums.

Issues like economic conditions or local regulations play a role for some riders.

How to Lower Insurance Costs?

I’ve found the best way to lower insurance costs is to shop around. Get quotes from multiple providers.

You can save more if you bundle policies like auto and home.

It also helps to have a clean driving record, have good credit, and request discounts from each scooter and moped insurance company.

Is Scooter and Moped Insurance Cheaper Than Motorcycles?

Scooter and moped insurance are often cheaper than a motorcycle policy, but some states and companies require each type to be insured under one two-wheel umbrella category.

Lower engine displacement, top speed ratings, and power impact your quote. I’ve found that usage is also a critical part of the process since shorter commutes deliver a better rate.

How Much Has Insurance Increased from the Year Before?

Scooter and moped insurance quotes are up about 5% in 2022 from the year before. Although prices are rising, a liability-only policy is still very affordable. Many riders can obtain coverage for less than $7 per month.

Are Electric Scooters Cheaper to Insure?

Electric scooters may be cheaper to insure than motorcycles because they are cheaper and have lower top speeds.

Some insurance companies may offer specific policies for electric scooters that are less expensive than traditional motorcycle insurance policies.

Use This Tool for Free and Save on Quotes!