I fell in love with the area around Ellijay when I was young, and that affair has only grown stronger as I’ve gotten older. When I can find time to take my motorcycle out for a long weekend or vacation, the North Georgia Mountains are where I go.

One of my favorite weekend activities is exploring the local vineyards. Several in the area offer tastings and tours, which creates a relaxing weekend when paired with Amicalola Falls State Park.

Didn't You Try Our Quote Comparison Tool Yet? Save BIG by Doing it!

Another fun option with a motorcycle in Georgia is the Tail of the Dragon at Deals Gap. Although this stretch of road is only 11 miles, it has over 300 curves to navigate.

You can also have fun taking your motorcycle along the Georgia coast. You’ll get beautiful water views while cruising through some charming communities.

Keeping your motorcycle insurance current is the best way to unlock all that potential. Here’s the information you need to know about rates and more.

Table of Content

Do I Need Motorcycle Insurance in Georgia?

Motorcycle insurance is necessary for owners in Georgia. The state requires all riders to at least carry liability coverage when operating their bike on public roads.

In Georgia, motorcycles are divided into three classes.

- Class A motorcycles have an engine displacement of 51cc or more.

- A Class B designation offers an engine displacement between 50cc to 150cc.

- With a Class M, you have a three-wheel vehicle with a 51cc or higher engine.

All riders must have a valid Class M license or a motorcycle permit to operate any of these vehicles.

What Are the Liability Minimums for Motorcycle Insurance in GA?

You’ll need a policy with 25/50/25 minimums when shopping for motorcycle insurance in Georgia.

- $25,000 bodily injury liability per person

- $25k in property damage coverage

- $50,000 bodily injury per accident

No minimums apply to collision, comprehensive, or uninsured/underinsured motorist coverage, as these are considered optional.

An SR-22 is required for motorcyclists who have had their license suspended or revoked, or have a conviction for certain traffic offenses, such as driving under the influence (DUI).

It is typically required for a period of three years after the offense, and during that time, you must keep your insurance policy active and paid.

You may need to pay a fee to have the SR-22 filed, and your insurance premiums may also increase due to the offense. The certificate itself is not covered. Not all providers offer this service, so requesting quotes from multiple companies might be necessary.

How Much Is Motorcycle Insurance in Georgia?

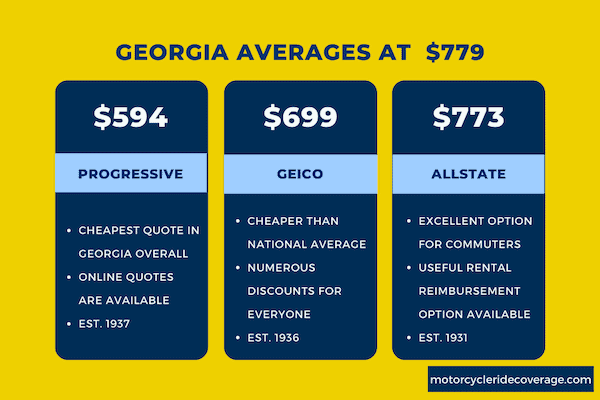

After securing multiple quotes in Georgia from different providers, the average policy cost for all ages and motorcycle models was $778.95.

Young riders pay about 40% more for their coverage, while those between the ages of 35-44 typically pay about 20% less.

Where you live significantly affects your annual rates compared to the state average.

- Riders in the Atlanta metro area pay over 43% more each year for their coverage.

- Those in Moultrie pay 14% less than the median cost.

- Significant savings opportunities are also available for motorcyclists living in Thomasville, Tifton, and Valdosta.

Those with a Harley-Davidson Street 500 have a cruiser-style bike perfect for city riding. It’s relatively inexpensive to insure compared to the CVO Road Glide or the Kawasaki Ninja H2.

You can also find significant insurance savings by riding motorcycles like the Suzuki DR-Z400SM, especially if you want a model with off-road capabilities.

Which Motorcycle Insurers Offer the Best Rates in Georgia?

When reviewing the quotes I received for motorcycle insurance in GA, Progressive was the clear favorite. Their rate was just under $600 for the year.

GEICO provided an offer that beat the state average for my insurance needs.

Each carrier offers specific strengths to consider for individualized situations, so here is a closer look at some common variables that could impact your choice.

| Motorcycle Insurance Provider | Annual Premium |

| Progressive | $594 |

| GEICO | $699 |

| Allstate | $773 |

Best Overall Provider: Progressive

Progressive is the best overall motorcycle insurance provider in Georgia for most riders. Not only are they $100 per year (or more for some) cheaper than the next company, but they also offer a fantastic selection of coverage choices.

You can find replacement cost coverage, enhanced injury protection, and specific add-ons that meet your riding needs.

The National Association of Insurance Commissioners (NAIC) gives Progressive a 0.66 rating for private passenger coverage. That means the company receives about two-thirds the number of complaints in its auto division compared to the typical agency of its size.

Best for Daily Riders: Allstate

Allstate offered a higher annual rate at $773.27, but that quote still beats the state’s average cost for motorcycle insurance. This provider delivers rental reimbursement as a feature, paying for a replacement option while your bike gets repaired.

It’s perfect for those who commute or ride their motorcycles daily.

In 2022, Allstate had total assets of $97.95 billion and earned $51.41 billion in total revenue. They’ve also received numerous customer service awards from J.D. Power and Associates.

Best for Older Adults: AARP

AARP motorcycle insurance from Foremost is an excellent choice for older riders. They have several optional coverage choices that let you tailor a policy to your requirements.

- You can purchase more than the standard $3,500 limit for optional equipment coverage.

- Transport trailer coverage of up to $7,500 is available.

- Towing and roadside assistance with trip interruption offers up to $500 in expenses for valid claims.

Foremost is a subsidiary of Farmers Insurance. It has received an A rating from A.M. Best, a rating agency that assesses the financial strength of insurance companies. They quoted a total cost per year of $796.50.

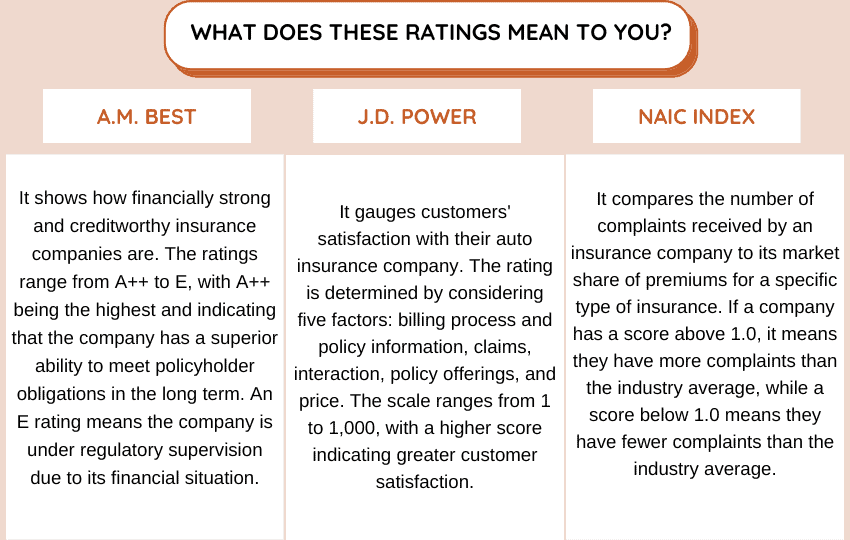

Make an informed decision with the help of the table below, which compares the financial strength, customer satisfaction, and complaint index of these companies.

| Providers | AM Best Rating | J.D. Power Index Ranking | NAIC Complaint Index |

| Progressive | A+ | 842 | 1.40 |

| Allstate | A+ | 833 | 2.40 |

| Foremost (Farmers) | A | 828 | 1.60 |

Options for Saving Money on Motorcycle Insurance in Georgia

The savings opportunities in Georgia for motorcycle insurance are highly individualized, but there are some steps everyone can take to reduce their policy costs.

- Take a Motorcycle Safety Course

Completing a motorcycle safety course often qualifies you for a discount on your premiums. Have a conversation with your insurer to see if they offer this savings opportunity.

Before obtaining a Class M license, all new motorcyclists under 18 must complete a Department of Driver Services (DDS) approved motorcycle safety course.

The state also offers the Georgia Motorcycle Safety Program (GMSP), which is a 20-hour motorcycle safety course designed to teach riders of all experience levels the skills they need to ride safely.

- Keep a Clean Driving Record

Avoid traffic violations and accidents to keep your driving record clean. Insurance companies often offer discounts to people they consider safe and responsible drivers.

Most traffic violations and accidents remain on your driving record for 24 months in Georgia. A DUI conviction lasts for ten years.

The number of points assessed for the offense may also impact your driving record and insurance rates. They’re added for each traffic violation and remain for two years.

- Have a Higher Deductible

Liability insurance doesn’t come with this option, but you can keep rates low by assuming more risks with your collision and comprehensive policies. If a claim occurs, you’ll pay more out of your pocket to complete repairs or purchase a replacement motorcycle.

Deductibles start at $100 and go up to $1,500 with most motorcycle insurers.

If there isn’t a lender lien on the motorcycle, you could opt for a liability-only policy. This option meets Georgia’s legal expectations but won’t offer the benefits of a collision or comprehensive policy.

- Consider Seasonal Motorcycle Insurance

In Georgia, many insurance companies offer seasonal insurance for motorcycles, which can be a good option if you only ride your bike during certain months of the year.

With seasonal motorcycle insurance, you can save money on premiums during the months when you don’t ride while still maintaining coverage for the times you want to explore.

FAQs

Motorcycle insurance in GA covers virtually all motorized two- and three-wheel vehicles. These questions often come up when shopping around for quotes.

Do You Need Insurance for a Moped in Georgia?

Georgia requires riders to have insurance for mopeds. All motor vehicles must have liability insurance to operate on public roads to cover damages or injuries you may cause to others or their property while driving.

Some insurers offer optional coverage such as comprehensive, collision, or uninsured/underinsured motorist coverage for mopeds.

Does Georgia Require Proof of Insurance?

Yes, you must carry proof of insurance when riding a motorcycle in this state. Any law enforcement officer, including state and local officials, can ask to see this documentation when pulling someone over on their bike.

Is Proof of Fault Required for Accidents in GA?

Georgia uses fault-based methodologies for insurance assignments after an accident or a collision. The individual who causes a wreck or property damage is financially responsible for making the others involved whole.

That means your insurance pays for a victim’s medical bills, property repairs, or additional losses.

It is up to the injured party to prove the other person’s fault. With this evidence, recovering compensation from an insurer might be possible.

Are There Motorcycle Equipment Requirements in Georgia?

Motorcycles must be declared “roadworthy” to operate in Georgia legally. If built after 1971, the bike must have turn signals, a mirror, a muffler, and a headlight. Passengers are only allowed if the design allows for proper sitting.

Where to Get Affordable Insurance Quotes for My Motorcycle in GA?

Motorcycle insurance in Georgia can be costly if you’re unsure how to obtain the appropriate quotes for your needs. But don’t worry; you don’t have to search any further. Utilize our tool below to get assistance. Shop around and cut costs on premiums.

Use This Tool for Free and Save on Quotes!