Motorcycle insurance is often a necessity. In some states, the cost is relatively minor. You can get adequate coverage for about the price of two coffees per month.

In other states, the cost of motorcycle insurance can be significant.

Didn't You Try Our Quote Comparison Tool Yet? Save BIG by Doing it!

Table of Content

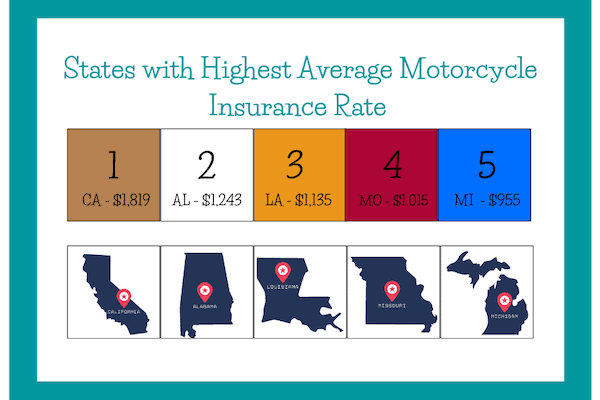

States with the Highest Average Motorcycle Insurance Rates

After chatting with numerous providers and receiving quotes in all 50 states and DC, I found the most expensive places for motorcycle insurance are California, Alabama, Louisiana, Missouri, and Michigan.

Here is the full list of average costs for you to check out.

We can also include Washington, DC ($1,404) in that conversation. It is second only to California but classified as a “district” instead of a “state.”

| States | Annual Motorcycle Insurance Cost |

| California | $1,819 |

| Alabama | $1,243 |

| Louisiana | $1,135 |

| Missouri | $1,015 |

| Michigan | $955 |

Why Is Motorcycle Insurance Expensive in California?

California has a high population density, meaning more vehicles are on the road, including motorcycles. The increased traffic volume presents a higher risk of an accident, often driving up insurance rates for everyone.

The state has strict insurance requirements. Liability coverage is often higher for motorcycles than other vehicles, which adds more to its comparative cost.

There is also the high cost of living to consider. Generally, when living in a specific area is expensive, you’ll pay more for your desired insurance.

Some insurers look at the issues of wildfires, earthquakes, and other natural disasters as another risk factor.

Why Is Motorcycle Insurance Expensive in Alabama?

This state experiences a high rate of fatal and severe motorcycle crashes, creating a risk factor for insurers that drives up the insurance rates. These accidents create medical bills and property damage contributing to these extra costs.

Many areas in Alabama experience high levels of vandalism and theft. These issues create higher rates because of the risk of loss presented to the insurer when requesting a quote.

Road conditions are another factor to consider. Much of the state is rural, which creates more opportunities for poorly maintained roads. If you were to be in a serious collision with limited access to medical facilities, the care costs could be extensive.

Why Is Motorcycle Insurance Expensive in Louisiana?

Louisiana offers a warm climate, so you can ride your motorcycle throughout the year. Without a seasonal layoff, you have more opportunities to experience a potential collision while exploring the open road.

If you’re involved in a motorcycle accident in Louisiana, the cost of medical care can be very high.

Louisiana has a limited number of options for motorcycle insurance coverage. That allows insurers to charge higher premiums because there is less competition.

Why Is Motorcycle Insurance Expensive in Missouri?

This state has a relatively high number of uninsured drivers on the road. If an accident occurs, the other driver or rider is more likely not to have the coverage required for taking care of their potential liabilities.

Missouri can experience severe weather conditions like tornadoes, floods, and ice storms. These conditions can increase the risk of accidents and cause damage to motorcycles, leading to insurance claims.

There tend to be more young riders and drivers on the road in this state, which adds to the risk factors that insurers evaluate when someone requests a quote for motorcycle insurance.

Why Is Motorcycle Insurance Expensive in Michigan?

Michigan uses a no-fault insurance system, requiring all riders to carry personal injury protection (PIP) coverage. It offers unlimited medical benefits to those injured in an accident, regardless of who is at fault.

Motorcyclists are viewed as a higher risk than automobile drivers because of their exposure.

There are also above-average rates of motorcycle accidents and uninsured drivers on the road, contributing to higher monthly and annual premiums.

What About Scooter and Moped Insurance Costs?

Scooter and moped insurance costs are highly variable across the United States. Some governments treat these vehicles as motorcycles, while others treat them as separate entities.

The most expensive places to insure scooters and mopeds tend to be those that classify all two-wheeled vehicles into the same category.

Your engine size matters when requesting a scooter or moped insurance quote. Although definitions are variable, most insurers look at the displacement rating (i.e., 50cc). Anything above 50cc typically has higher rates.

How to Lower Your Motorcycle Insurance Costs

Shopping around for the best rates is one of the best ways to lower your overall insurance costs. You can select a plan from the provider that delivers the most value for your specific needs.

Here are some additional strategies that could work in your situation.

- Increase Deductibles. Raising the amount you pay out of pocket before your insurance kicks in can lower your monthly or annual costs.

- Bundle Policies. If you have a moped and a motorcycle to insure, consider putting them on the same plan. Many insurers offer a discount through bundling.

- Driving Record. Safe driving habits can help you qualify for lower insurance rates. Young riders (25 or younger) can be eligible for student discounts on top of this savings opportunity by maintaining a 3.0 or 3.5 GPA or better.

- Make and Model. Some motorcycles have a higher MSRP, translating to a bigger insurance price tag. Consider choosing a bike that costs less to keep your premiums lower.

If you don’t ride your motorcycle year-round, you can save money by purchasing storage insurance during the off-season.

Although you could decide to move to a cheaper state, it often makes more sense to follow cost-lowering strategies to save some money on motorcycle insurance. In return, you’ll have a little more in your pockets for those days you explore.

Use This Tool for Free and Save on Quotes!