The Polaris Slingshot is an incredible three-wheel motorcycle with a setup that follows the reverse trike dynamic. As with any other vehicle on roads and highways, it must meet the insurance requirements for where you live to operate legally.

Today’s best insurance companies deliver several excellent options to consider when you need to insure a Polaris Slingshot. You’ll want to speak with a local agent or broker to determine if you need a motorcycle, trike (3W), or autocycle insurance based on local regulations.

Didn't You Try Our Quote Comparison Tool Yet? Save BIG by Doing it!

Table of Content

- Do You Need Insurance for a Slingshot?

- What Type of Insurance Do You Need for a Slingshot?

- How Much is the Insurance for a Slingshot?

- How to Save on Insurance?

- Where Can I Obtain Polaris Slingshot Insurance?

- What Is the Process to Follow if My Polaris Slingshot Is Stolen?

- FAQ on Polaris Slingshot Insurance

- Can You Get Insurance for a Slingshot without a Driver’s License?

- Can You Use Car Insurance for a Polaris Slingshot?

- What If I Have an Out-of-State Accident with My Polaris Slingshot?

- What to Consider When Adding a Second Driver for a Polaris Slingshot?

- Should I Have Liability Only or Full Coverage for My Polaris Slingshot?

Do You Need Insurance for a Slingshot?

The Polaris Slingshot must have insurance coverage if it operates on local roads, streets, and highways. Without this coverage, fines and penalties could be significant. In several US states, driving without appropriate policies is charged as a misdemeanor crime.

Florida takes a different approach to its insurance requirements for motorcycle riders and those with similar equipment. Although you don’t need to carry insurance for the vehicle, you are held financially responsible for any property damage or injuries caused during a collision.

If you drive a Polaris Slingshot, you can file a certificate stating you have the financial means to cover damages you cause while operating the vehicle.

What Type of Insurance Do You Need for a Slingshot?

The Polaris Slingshot is a unique three-wheeled vehicle that drives like a car but rides like a trike. It delivers the feeling of being on a motorcycle while offering the comfort of a bucket seat and a steering wheel.

When looking for insurance requirements to operate a Slingshot on the road, you’ll need to see what the expectations are in your state, city, or community.

The insurance requirements typically fall into three categories.

- Motorcycle Insurance. You might need to follow a general classification that involves all vehicles that don’t have four wheels. These policies are typically geared toward motorcycles, mopeds, and scooters but can include trikes.

- 3W Insurance. Three-wheeler insurance is available in some areas to cover the specific needs of trike owners. The Polaris Slingshot typically qualifies for this policy type unless your state classifies the vehicle as an autocycle.

- Autocycle Insurance. An autocycle definition is variable, but most states require the vehicle to be partially or entirely enclosed for this insurance to be necessary. Get to know about Vanderhall insurance here.

How Much is the Insurance for a Slingshot?

The cost of insurance for a Slingshot can vary greatly depending on several factors, such as the operator’s driving record, the features of the trike, and their location within the United States. While the average cost for basic coverage is around $1,200 per year, some individuals may see their premiums triple due to their unique circumstances.

Is Insurance High on a Slingshot?

A full-coverage policy for a Polaris Slingshot is comparable to the price of other motorcycles and trikes. If you operate the vehicle only during the summer season, your insurance pricing could be as low as $350. When you want year-round protections for this investment, most riders expect to pay about $1,000 to $1,500 annually.

How to Save on Insurance?

The best way to keep costs down when insuring a Polaris Slingshot is to have a clean driving record and experience operating bikes and trikes. If you’ve had a 3W or a motorcycle endorsement on your license for at least three years, you’re more likely to be on the lower end of the expected cost.

The license requirement to ride such a vehicle might vary from state to state. Here is some important information.

If you’re a young rider (under 21) with no motorcycle experience, your insurance policy quote will likely be on the upper end of the pricing scale.

Young riders can lower costs by maintaining good grades, operating with the minimums, and having a higher deductible.

Even at the higher end of the pricing spectrum, a Polaris Slingshot is about 50% of the cost of the typical automobile to protect through insurance. The prices are roughly equal to trikes and motorcycles.

Where Can I Obtain Polaris Slingshot Insurance?

Most major insurance providers offer Polaris Slingshot insurance. You can work with companies like Progressive, Allstate, and GEICO.

When you start looking for insurance coverage, it helps to get quotes from at least three different companies. By shopping around, you can know for certain that you’re getting the best deal.

A Polaris Slingshot typically needs comprehensive, collision, and liability coverage, especially if the purchase was financed. If you only drive during the summer, you can request a seasonal policy that lasts all year.

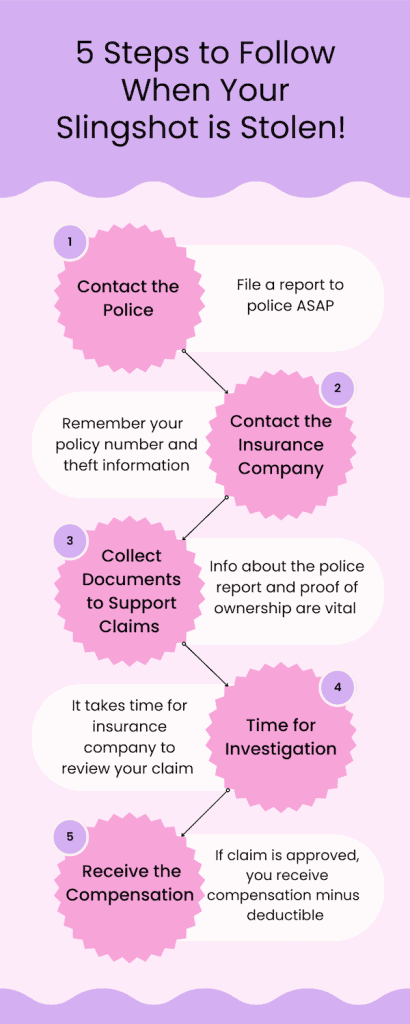

What Is the Process to Follow if My Polaris Slingshot Is Stolen?

If your Polaris Slingshot has been stolen, you should take the following steps.

- Contact the police. The first step is to file a police report as soon as possible. This document will be necessary for the insurance company and can help law enforcement recover your stolen Slingshot.

- Contact your insurance company. You’ll need your policy number and information about the theft, such as when and where it occurred.

- Provide documentation to support the claim. This paperwork could include the police report, proof of ownership, and other relevant information.

- Wait for the investigation. Your insurance company will review the claim to determine whether it is valid and covered by your policy. It could take some time, as the insurer will need to gather information from the police and review your policy details

- Receive compensation, at least if your claim is approved. It will be minus any deductible that applies to your policy.

It’s important to note that the specific insurance process for a stolen Slingshot may vary depending on the insurance company and policy details. It helps to review your policy documents and contact your provider with any questions or concerns.

FAQ on Polaris Slingshot Insurance

Can You Get Insurance for a Slingshot without a Driver’s License?

Polaris Slingshot owners can purchase insurance if they have an “insurable interest” in the vehicle. Buying a policy is usually possible if other drivers are on the policy, such as teens in your home.

When you’re the only driver, insurance for comprehensive and collision could still be available. Since you aren’t permitted to operate the vehicle on public roads without a license, there could be liability limitations to manage.

Can You Use Car Insurance for a Polaris Slingshot?

A Polaris Slingshot is classified as a three-wheel vehicle, an autocycle, or a motorcycle. The actual definitions are based on where you live. You’ll need to buy an insurance policy based on those local requirements.

If you drive your Slingshot to a different state, the policy requirements for where you live typically apply. There could be an issue if you’re pulled over and must present evidence of a specific policy. Research what is necessary at your intended destination to ensure your coverage meets or exceeds expectations.

What If I Have an Out-of-State Accident with My Polaris Slingshot?

If you have an out-of-state accident with your Polaris Slingshot, you first should seek medical attention if you or others in the accident require it. Once you have addressed any injuries or medical needs, you should take steps to document the accident and exchange information with any other drivers or witnesses.

In terms of insurance,

It’s important to note that Polaris Slingshot is typically classified as an autocycle, which means it’s regulated differently than a traditional motorcycle or car. Your policy for the Slingshot should cover accidents occurring outside of your home state, but the coverage may differ depending on the specifics of your policy.

You should contact your insurance provider as soon as possible to report the accident and determine the extent of your coverage.

It’s also a good idea to contact a local attorney specializing in personal injury law, mainly if the accident resulted in significant damage or injury. They can help you navigate the legal process, communicate with insurance companies, and seek compensation for accidental losses or damages.

What to Consider When Adding a Second Driver for a Polaris Slingshot?

Since a Polaris Slingshot only requires a driver’s license in 49 out of 50 states, you can add any household driver to an insurance policy. The process is like that of adding people to cars, trucks, vans, or SUVs.

Since secondary drivers have unique risk factors to consider, their driving record, credit history, and other variables could cause rates to rise. This issue is especially prevalent for those under 25 getting added to a Slingshot policy.

Should I Have Liability Only or Full Coverage for My Polaris Slingshot?

If you financed your Polaris Slingshot, the lender typically requires full insurance. That includes liability, comprehensive, and collision.

Insurance is meant to limit financial risks if something unexpected happens. With liability only, you won’t be protected from other damage that could occur, including fire and flood. It is usually better to have complete coverage, but an older Slingshot might benefit from only covering what happens in an at-fault collision.

Use This Tool for Free and Save on Quotes!