I love how North Carolina has a scenic route around every corner. You’ll find a wide variety of landscapes and activities to enjoy on a motorcycle, whether you’ve got a day to explore or an entire week for a cruise.

The Coastal Crescent is one of my favorite routes in the United States. Take a trip along the southeastern coast of North Carolina, starting in Wilmington and continuing through charming coastal towns like Southport, Oak Island, and Beaufort. There are plenty of gorgeous beaches along the way and fresh seafood to enjoy.

Didn't You Try Our Quote Comparison Tool Yet? Save BIG by Doing it!

If you love the coastal environments of North Carolina, then the Outer Banks Scenic Byway is an excellent option. You can see Cape Hatteras, Bodie Island, and Roanoke, with historic lighthouses and welcoming fishing villages.

From Route 64 to the Great Smoky Mountains Loop, there is something for everyone to enjoy in North Carolina! That’s why verifying your motorcycle insurance is current is a good idea.

Table of Content

- Is Motorcycle Insurance Mandatory in North Carolina?

- What Is the Cost of Motorcycle Insurance in North Carolina?

- Motorcycle Insurers Offering the Best Rates in North Carolina

- What Can I Do to Keep My Motorcycle Insurance Rates Low in NC?

- FAQ About Motorcycle Insurance in North Carolina

- How Do You Get Motorcycle Insurance Quotes in NC?

Is Motorcycle Insurance Mandatory in North Carolina?

North Carolina requires all motorcycle owners to purchase at least a liability policy with specific minimums to drive on public roads legally.

If you use your motorcycle for commercial purposes, you’ll need a separate policy for those activities. These vehicles must meet higher liability coverage limits and could require additional coverage, even if you only transport goods in the gig economy.

Although uninsured/underinsured motorist coverage isn’t required in the state, it is strongly recommended to have it if you can afford it.

What Are the Minimum Liability Requirements in NC?

The current minimum liability requirements in North Carolina are 30/60/25, which is one of the highest required rates in the country right now. That means your policy must provide the following.

- $30,000 in bodily injury coverage (BIC) per person.

- $60k in BIC per incident.

- $25,000 in property damage coverage.

If your policy doesn’t meet these minimums, it is like having no insurance while driving. Insurers know these requirements, so your quote should reflect those amounts.

You can purchase more coverage beyond these minimums, including collision and comprehensive policies.

What Is the Cost of Motorcycle Insurance in North Carolina?

With an average policy cost of $937.13, North Carolina is above-average with its median insurance rates for motorcyclists. Young riders see rates average around $1,500, while those in their 20s are still paying over $1,000 per year.

You can drop your insurance rates to something more affordable if you have a clean driving record and three years of riding experience. It will still be higher than other states further west.

Where Can I Find the Cheapest Rates in NC?

- The cheapest motorcycle insurance rates were found in Boone, which were over 10% less than the state average.

- In my research, Chapel Hill and Asheville were 9% lower.

- Hickory, Asheboro, Eden, Havelock, and Morganton were about 75 lower than the median.

- Fayetteville riders paid the most in the state, with rates 29% higher than average.

- Gastonia, Jacksonville, Lumberton, Raleigh, and Wilson motorcyclists saw increases ranging from 7% to 15% more.

Motorcycle Insurers Offering the Best Rates in North Carolina

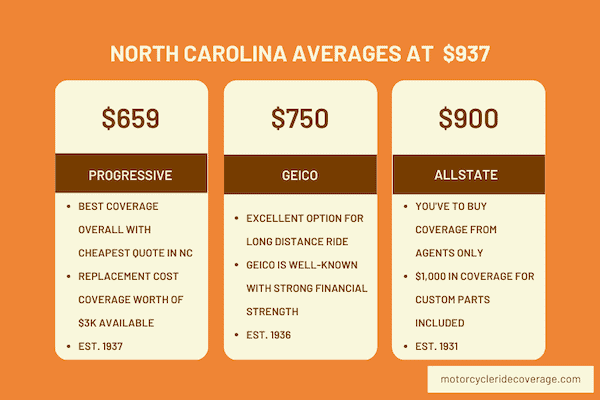

Progressive offered me a fantastic quote when I asked about motorcycle insurance in NC. Their price of $659 per year was significantly lower than anyone else. GEICO delivered the next best deal, asking just under $750 for a policy.

After that, Allstate came in next. They offered me similar coverage for about $900 annually.

| Motorcycle Insurance Provider | Annual Premium |

| Progressive | $659 |

| GEICO | $750 |

| Allstate | $900 |

Best Overall Provider: Progressive

Progressive is the only choice for this pick. They offer the best rates, a wide range of discounts, and plenty of add-on options for those with custom rides.

Even if you choose the standard policy for your motorcycle, several perks are available that you would pay more to get from other companies. Replacement cost coverage is included, as is $3,000 in custom parts protection.

Best Choice for Long-Distance Rides: GEICO

I prefer GEICO for riders who like long days on the road. This insurance company has nationwide support, ensuring you won’t be stuck between a rock and a hard place if something happens.

The prices are still reasonable and much lower than the state’s average. Although fewer discounts are available than other insurers, the convenience you get with online policy management and 24/7 support is worth having.

An in-depth review of GEICO is here.

Best Pick for Families: USAA

I like USAA here if you qualify for services. The policies come through Progressive but at a discount for military personnel. Outside of GEICO, it is the only major company to earn an A++ A.M. Best rating in the state for financial stability.

You have multiple ways to bundle and save through USAA, and many families qualify for several discounts.

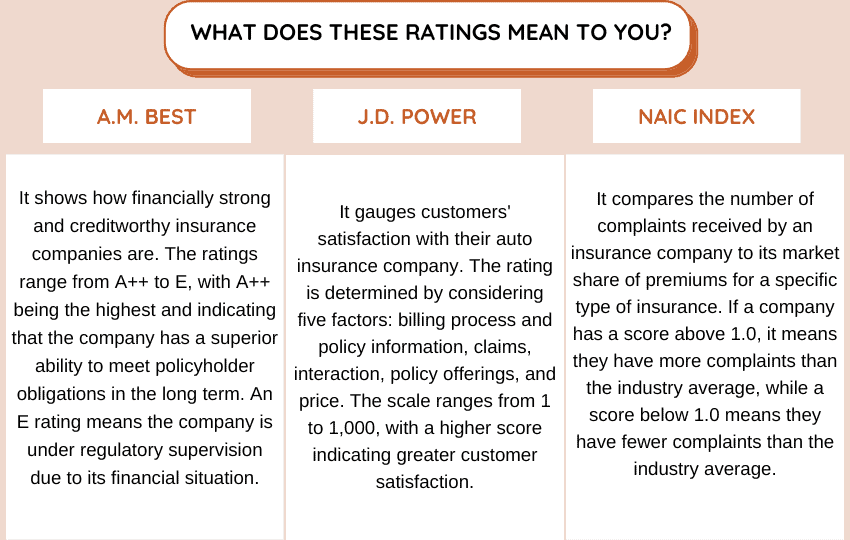

Now let’s scrutinize these providers in North Carolina regarding their financial strength, customer satisfaction, and complaint index rating.

| Providers | AM Best Rating | J.D. Power Index Ranking | NAIC Complaint Index |

| Progressive | A+ | 842 | 1.41 |

| GEICO | A++ | 843 | 1.21 |

| USAA | A++ | 886 | 1.65 |

What Can I Do to Keep My Motorcycle Insurance Rates Low in NC?

The easiest way to keep your motorcycle insurance costs lower in North Carolina is to maintain a clean driving record.

When there are no traffic citations or accidents on your record, you present as a lower risk to the insurer. That translates into a cheaper premium. Here are some additional steps you can take to lower your rates.

- Install Security Devices

Outfitting your motorcycle with security devices like alarms, immobilizers, and GPS tracking systems can deter theft and reduce the risk for insurers. Some companies provide discounts if you can verify you’ve made these additions.

- Store the Bike Securely

Parking your motorcycle in a secure location, such as a locked garage, can lower the risk of theft or damage, potentially leading to lower insurance rates.

- Evaluate Your Coverage Options

Review your insurance policy regularly to ensure you have the appropriate coverage for your needs. Adjusting levels or removing unnecessary add-ons can keep your premiums low.

- Maintain Continuous Coverage

Avoid having lapses in your motorcycle insurance coverage. When there is a history of continuous coverage, you demonstrate responsibility to insurers. That can lead to lower rates.

- Increase Deductibles

Consider raising the amount you pay in the event of a claim to save money on your motorcycle insurance. This step lowers your risk factors but raises how much you’ll pay if repairs are necessary.

FAQ About Motorcycle Insurance in North Carolina

If you’re interested in owning or riding a motorcycle in North Carolina, these questions might arise during your quote request. Here are the answers you’ll need to proceed.

How Are Insurance Costs Managed in North Carolina?

The NC Rate Bureau represents insurance companies in the state. They are not part of the Department of Insurance.

By law, they must submit rate filings with the department each year before February 1. To file this documentation, the commissioner and their staff must provide evidence as to why the request is justifiable.

If the department doesn’t agree, the two parties work toward a settlement. In 2023, the request was to raise insurance rates by nearly 29%.

Do You Need Insurance to Register a Motorcycle in NC?

You must show proof of insurance in North Carolina to register your motorcycle. You must own or operate one with the proper minimum liability coverage. It takes 7 days from the time you’ve submitted the notarized title application form to complete this process.

Owners must re-register their motorcycles each year to remain compliant with these expectations.

How Do You Get Motorcycle Insurance Quotes in NC?

When shopping for car insurance in North Carolina, it’s important to note that the state has high minimum liability requirements. We recommend comparing quotes from multiple providers to ensure you get the best rates. We are here to assist you with this matter.

Use This Tool for Free and Save on Quotes!